Digital accounting

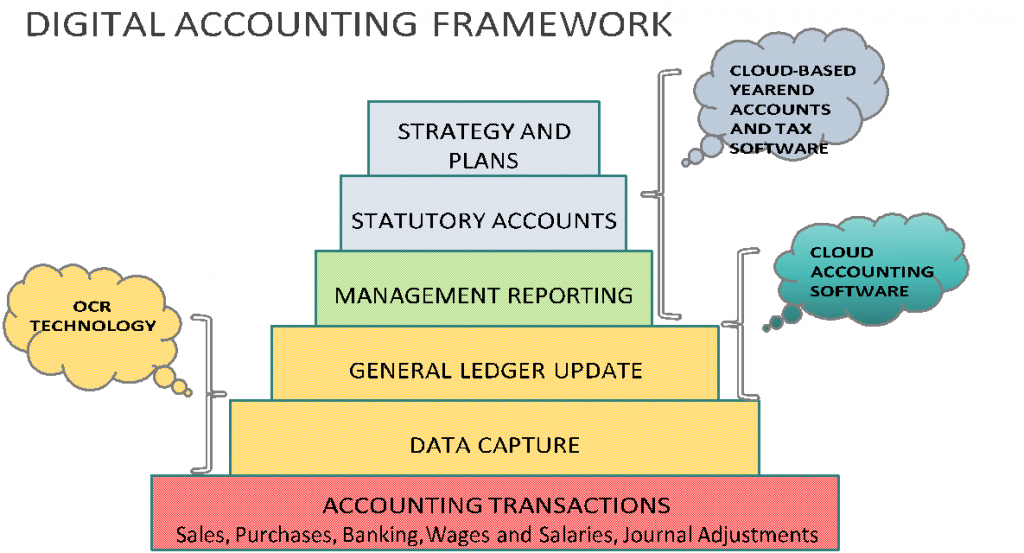

Digital Accounting is the integration of cloud accounting and electronic data capture to provide a digital accounting working environment.

Software companies like QuickBooks and Xero have disrupted traditional accounting software with subscription-based cloud accounting software. Developments in Optical Character Recognition, open banking and cloud technology are the cornerstone of the digital accounting revolution.

Digital Accounting is a bottom-up framework which facilities near realtime management and financial reporting through automated data capture of general ledger transactions.

The process involves:

- electronic data capture of accounts receivable invoices and payable source documents, such as sales invoices and receipts, respectively

- integrated bank transactions using either Open Banking Technology or important bank transactions

- realtime update of general ledger and bank transactions

- on-demand management reporting

- full integration with statutory accounting and tax accounting applications

- on-demand reporting of strategic plans and executive information reporting

Operational benefits

- Automated Data Entry

- Integration with financial reporting and tax software

- Timeliness and accuracy of accounting information

- Remote access using multiple devices, such as smartphones, tablets and laptops

TECHNOLOGY BENEFITS

- Data held on remotely on secure cloud servers

- Centralised user-access security and backups

- Centralised operational and technical support

- NB: The model assumes 24/7 internet connectively

Digital accounting course outline

Our digital accounting course are delivered by qualified bookkeepers and accountants using Zoom or Microsoft Teams. Xero will be the main accounting software but attendees will be given access to Quickbooks and Sage accounts.

Electronic data capture covers:

- using electronic data capture software to upload supplier receipts and customer invoices

- categorising expenses to the correct accounts code

- assigning the correct VAT codes to receipts and customer invoices

- reviewing and rectifying or resubmitting rejected documents

- submitting transactions to the linked cloud accounting general ledger

Accounts receivable covers:

- adding and maintaining customer accounts

- creating sales invoices and credit notes

- allocating the correct VAT codes to invoices

- generating monthly account statements

- producing aged debtors reports

- reconciling customer account balances

Accounts payable covers:

- adding and maintaining supplier accounts

- reviewing and updating bills/receipts and credit notes

- reviewing the correct allocation VAT to receipts

- producing aged creditors reports

- reconciling supplier account balances

Bank reconciliation covers:

- matching payments to supplier receipts

- matching receipts to customer invoices

- allocating receipts to multiple sales invoices

- allocating payments to multiple supplier bills and receipts

- Categorising direct expenses and overheads using the chart of accounts

- reconciling differences between the bank balance and the accounts balance

General ledger covers:

- reviewing nominal account balances for the month, quarter and financial year

- using the trial balance to review nominal account balances

- reviewing cash and bank balances

- preparing management accounts to include profit and loss account, balance sheet and cashflow statements by month, quarter and year

Journal adjustment covers:

- Preparing accruals, prepayments and depreciation journals

- Preparing reversing journals for accruals and payments

- Preparing adjustment journals to correct mis-postings to the general ledger and bank accounts

- Preparing quarterly VAT returns and verifying the correct VAT classification for sales and purchase invoices

- Management and financial reporting covers:

- Preparing monthly, quarterly and annual trial balance, profit and loss account and balance sheet

- Preparing comparative trial balance, profit and loss account and balance sheet